Home Depot Q1 Preview: Long Term Prospects Are Encouraging & Valuations Are Attractive

[ad_1]

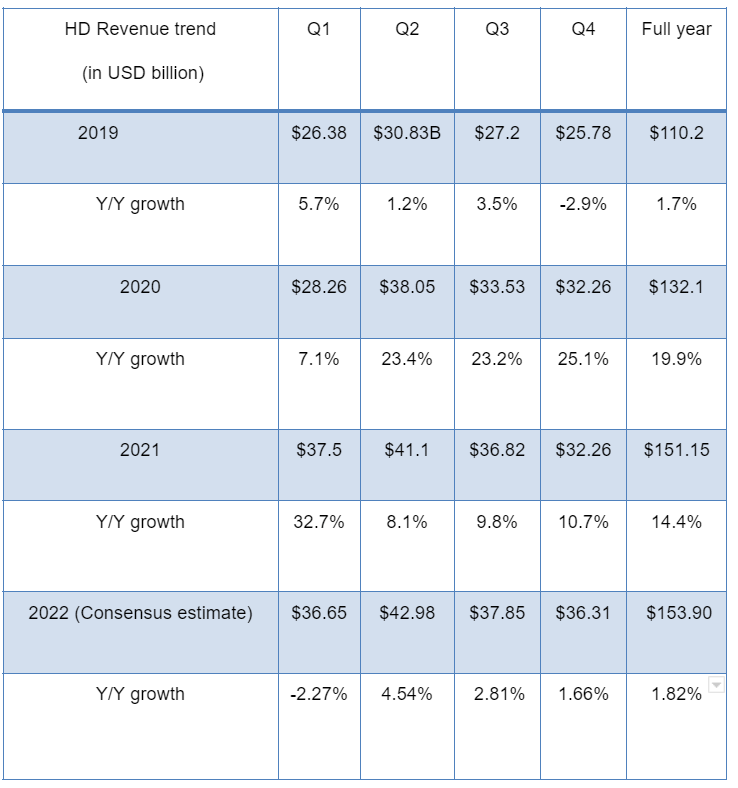

Justin Sullivan/Getty Illustrations or photos News

House Depot (NYSE:High definition) is set to report its earnings on Tuesday, May possibly 17th, right before the sector opens. For the reason that of the harder comparisons (both equally 1 year as perfectly as two-calendar year stack basis) and macro-associated headwinds, profits and operating margins are envisioned to be lower in Q1 2022 than in Q1 2021. Analysts are estimating a complete earnings of ~$36.67 billion, down by ~2.27% in comparison to Q1 2021 documented profits. For EPS, the consensus is at $3.68 for Q1 2022 or a ~4.6% decline compared to $3.86 very last yr. Whilst the enterprise is struggling with macro-connected headwinds, the valuation is low-priced and a great deal of these headwinds appear to be already priced in to the stock at the recent concentrations. The very long time period story continues to be intact and management’s growth and margin initiative will carry on to assistance travel the stock’s outperformance in the more time phrase.

Earnings Anticipations and Outlook

Back again in February, though reporting the Q4 success, administration furnished the FY22 advice for income growth to be a little bit optimistic and running margin roughly flat in comparison to fiscal 2021. The consensus estimates for FY22 are developing in 1.82% income advancement in line with the company’s advice for FY22.

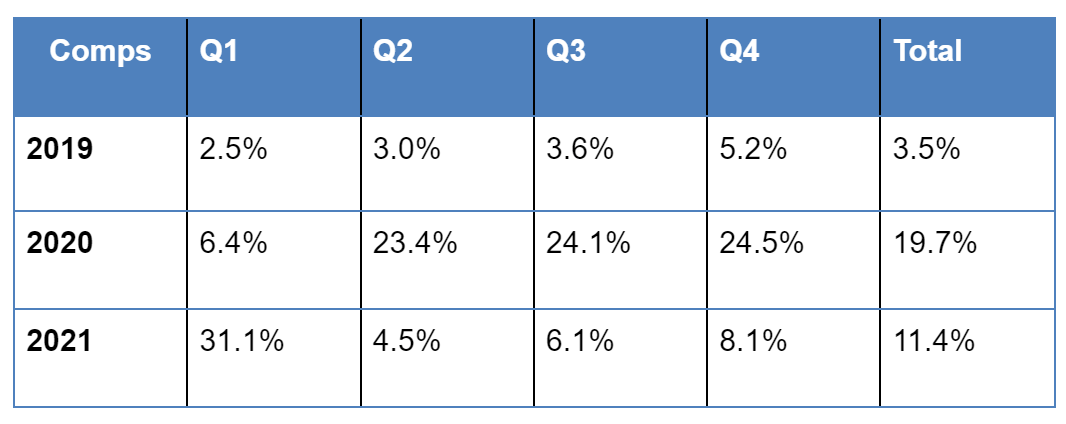

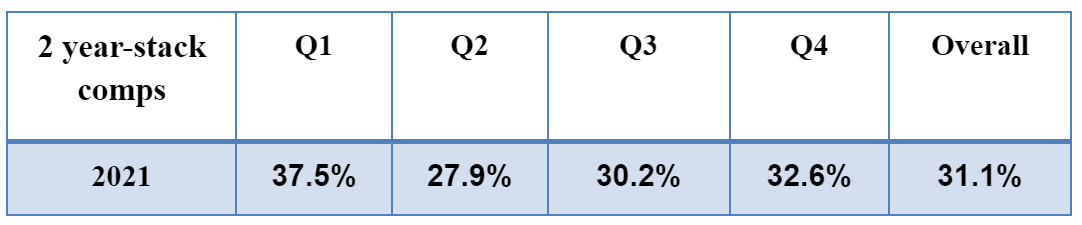

Administration hasn’t provided quarterly income advice but if we look at the provide-aspect estimates, they assume a decline in Q1 with the firm returning to progress from Q2 onwards. This helps make feeling as comparisons are tougher in Q1 2022 on both of those 1-yr as nicely as the 2-calendar year stacked basis. Analysts are estimating revenue of $36.65 billion in Q1 2022, a drop of ~2.27% from the actual noted income in the exact quarter very last calendar year. In Q1 2021, the enterprise recorded comps of 31.1%

High definition Comps Gross sales (Enterprise Information, GS Analytics Exploration) High definition 2-12 months Stacked Comps Profits (Business Info, GS Analytics Investigate) High definition Revenue Progress (Business Facts, In search of Alpha Consensus Estimates, GS Analytics Investigation)

Whilst comps are more durable in Q1 2022, if we look at commentary from some of the firm’s more compact peers as well as suppliers, the underlying need development in the remodelling sector appears healthful. Even though transaction and volume development is acquiring impacted by robust need from previous calendar year (hard comps), lots of businesses were being able to raise selling prices which resulted in income advancement.

On its most current earnings get in touch with, Ground & Decor (FND) talked about declining transaction figures as it laps the strong demand from customers and harder comparison in contrast to the previous calendar year. But it also talked over the boost in ticket sizing thanks to the even now healthy market place situations which enabled them to increase price ranges and offset the lower in the quantity of transactions. Floor and Decor was not by yourself, even the company’s distributors like Fortune Brands (FBHS) and Masco (MAS) talked about their means to enhance charges for the end clients on their modern earnings simply call.

We anticipate very similar dynamics for Property Depot as effectively, which may possibly offset some impression of more durable comps.

Some investors are also concerned about soaring interest premiums and its effect on Residence Depot. Even so, if we glimpse at historical trends, remodelling activity has been extra dependent on home fairness and housing costs instead than desire costs. Home owners commonly have a tendency to shell out additional on household advancement initiatives if the housing costs are soaring. So, I am not as well apprehensive about growing curiosity fees.

One matter which does get worried me, however, is the impression of economic reopening and normalization on the in the vicinity of term demand from customers. For the very last two a long time, individuals benefitted from stimulus checks and considering that they had less avenues for paying outside their households thanks to lockdown, they spent a sizeable amount of money on household improvement. What effects the financial system reopening has on this demand is a thing to enjoy intently and any commentary from management on it will be useful.

Margin expectation and outlook

On Home Depot’s previous earnings connect with, management presented the assistance of a flat running margin for FY22 when compared to FY21. However, I consider factors have worsened really a bit since then in conditions of provide chain disruption and headwinds owing to the Russia-Ukraine conflict and lockdowns in China. The company and its distributors source some of their inventory/SKUs from China and Europe. With geopolitical tensions and incremental lockdowns related to Omicron in China, there might be some tension on margins in the close to phrase.

On the other hand, I am not way too apprehensive about it as Property Depot is a very well-operate enterprise with a leadership place in its business. It can arrange for choice choices if it is not able to resource some SKUs from China because of to limited accessibility to Chinese ports. The enterprise may incur some extra costs in the in the vicinity of phrase as a end result, but in the extensive time period it must be capable to go any inflationary prices to the conclusion shopper.

Extensive-expression Progress Initiatives

Whilst there are short time period fears, most of them are macro associated and not organization-particular. Most firms throughout several industries are experiencing identical offer-chain and inflation-associated headwinds.

But inspite of these in the vicinity of-term headwinds, the firm’s prolonged-term growth narrative continues to be intact. On its last earnings phone, management shared its long phrase intention of reaching $200 billion in revenue with improvement in in-shop productiveness and price tag reduction. I consider these aims will keep on being intact and the enterprise will not only be able to navigate through in close proximity to-expression macro headwinds, but also arise much better on the other facet.

In my earlier report, I reviewed some of the initiatives House Depot is taking in phrases of house optimization and building out flatbed distribution centres to aid well timed delivery to Pro shoppers. It will be intriguing to get updates from management on these initiatives as perfectly as other strategic lengthy-term ambitions in the course of the forthcoming meeting call.

Valuation and Conclusion

Residence Depot is at the moment buying and selling at ~18.18x FY23 (ending January 23) consensus EPS estimates vs . its five-yr average adjusted P/E (FWD) of ~21.90x. I feel the company’s extended expression development tale remains intact and specified its market place leadership posture, historical past of great execution as perfectly as company-certain expansion initiatives, long-expression investors can make use of the modern correction to purchase the inventory.

[ad_2]

Supply hyperlink