Skyrocketing lumber costs increase charges for new Seattle-area homes. Will potential buyers proceed to spend?

Add one much more issue to the rising expense of new housing in the Seattle spot: skyrocketing lumber prices.

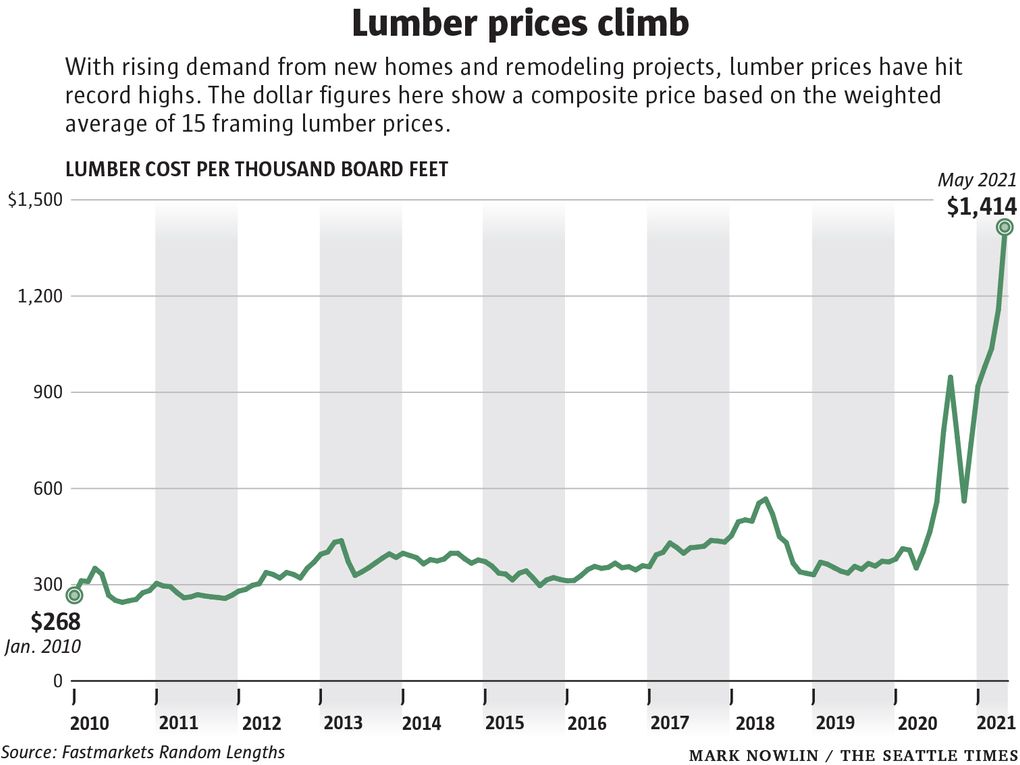

Nationally, lumber price ranges have much more than tripled in the earlier calendar year. That can insert tens of hundreds of dollars to the selling price of a new dwelling or town household.

In Seattle’s very hot housing market, developers say one-relatives household prospective buyers so significantly are still ready to pay out. For apartment buildings and affordable housing, the math is far more challenging. Rents in the city have dropped in the yr since the pandemic strike. Confined funding for affordable housing squeezes all those budgets tighter.

Nonprofit developer Bellwether Housing, which options a 186-device apartment sophisticated in the Rainier Valley, in December envisioned framing lumber to charge $1.49 million. Now, that’s up by $850,000, a 57% raise in lumber expenditures, claimed Richard Bathroom, Bellwether’s director of authentic estate advancement.

At the other conclude of the housing selling price spectrum: At a subdivision by Terrene Households just outside the house Kirkland, wherever selling prices for new properties are all-around $2 million, lumber charges are introducing $40,000 to $50,000 to the cost of every residence.

In between, at a Bothell progress of 11 city houses, lumber costs doubled from the time development started in early 2020 to Oct, when framing began, stated Cameron McKinnon, director of acquisition and development at Gamut360 Holdings. Which is additional about $30,000 per residence and 10% to the project’s in general budget, driven typically by lumber, he explained.

So, are increasing lumber price ranges the cause homes are so expensive in the Seattle location? Not precisely. Much less than a single in 5 properties for sale in the metro location are new construction. Document-superior home rates in this article have been pushed by a slim supply of homes, and metropolitan areas all above the place are observing a identical development.

“If it was not materials, it would be some other bottleneck mainly because demand from customers is just so significant. It’s very impossible to satisfy the desire,” claimed Redfin chief economist Daryl Fairweather.

But for new development, budgets are now riddled with problem marks.

Other components are also costing extra or are challenging to locate, from steel and siding to insulation and appliances, builders say.

“We’ve in no way observed just about anything like this just before,” said McKinnon, who is also board first vice president of the Grasp Builders of King and Snohomish Counties.

And if expenditures retain rising, new homes could slip even further out of access, primarily in a lot more reasonably priced regions exterior Seattle.

“Construction represented maybe 1 probable aid valve” from growing charges, explained Zillow economist Jeff Tucker, “and this is shrinking that reduction valve.”

The most current price hikes for lumber come as the charges of other merchandise like gasoline are climbing also, stirring up fret that inflation could jeopardize the country’s financial restoration.

A storm of components is driving up the cost of lumber.

Early in the pandemic, mills shuttered quickly, going through shutdown orders and bracing for an economic downturn. The capability for softwood lumber generation fell approximately 16% in the first quarter of 2020, according to one estimate.

“The pandemic began and we assumed, ‘Oh my goodness, below arrives yet another Fantastic Economic downturn,’” stated Steve Zika, CEO of Hampton Lumber, which owns three mills in Washington, additionally other individuals in Oregon and British Columbia, and sells to lumber distributors and property facilities.

Hampton shut mills for only about a week or so, but other people paused longer, anxious demand from customers may well plummet, Zika reported.

As a substitute, demand spiked, both among house owners looking to rework and among homebuilders. U.S. housing starts off this March were up 37% from a 12 months before.

Insert to that extensive-operating concerns in the source chain — like mills that lower back generation or closed through the Terrific Economic downturn, pine beetle destruction of forests, and a scarcity of workers, which includes truck motorists.

“For the time staying, it is just a traditional ‘there’s as well a great deal demand for the amount of lumber,’” Zika stated.

Timber harvests on state-managed lands in Washington are on the decline amid environmental issues, but more provide could come from the southern United States and Europe. Hampton is making yet another sawmill in British Columbia.

Elevated source could finally generate price ranges back again down, Zika mentioned. “I do inevitably be expecting source and demand to get in balance. No one genuinely is familiar with if that’s three months away, 6 months absent or two or a few several years away.”

In the hottest places of the neighborhood single-household home current market, potential buyers are so far however keen to pay.

At that $2 million-a-household Kirkland subdivision, even with a price bump from climbing lumber selling prices, “we have many-present predicaments on personal homes,” claimed Wade Metz, companion at Terrene Households.

For now, “demand has been there,” reported McKinnon. “That need has driven up the rates in housing to go over people cost overruns, but that only works when the demand from customers exists.”

The equation is various for apartment properties. Rents in Seattle dropped all through the pandemic as some tenants moved farther out to conserve funds or get more house.

For cost-effective-housing builders, who restrict rents dependent on earnings, margins for additional expenditures are slender.

The consequences of rising prices have been ramping up for Bellwether.

The nonprofit commenced design on a few tasks previous calendar year after the start out of the pandemic. 1, a substantial-rise, wasn’t affected by lumber price ranges for the other two, contractors absorbed some or all of the improved expenses utilizing their contingencies, and in just one circumstance Bellwether had to spend about a third of the increased price. Now, Bellwether is grappling with expenditures for the Rainier Valley challenge.

To go over the hole, the nonprofit is looking into adjustments to the job or aid from its loan company. If that does not function, Bellwether may possibly talk to community funders like the city’s Office of Housing for additional cash.

Seeking even farther in advance, “it’s tough to strategy,” Loo said. “How much certainty do we require? Are we likely to overpay if we lock in our charges for lumber now?”

Market place-rate condominium builders could acquire a pause.

Marpac Construction’s consumers have put 3 industry-charge condominium projects on keep so far, about a third of the common contractor’s jobs, claimed associate Sai Chaleunphonh.

The company’s economical housing assignments are even now underway, but lumber, concrete, steel and other provides are incorporating new expenditures.

“If it was just lumber, then it’s not a huge cost,” Chaleunphonh said. Incorporate the other fees and “it becomes a 15% improve.”

Remodelers see rate spikes, far too

Homebodies performing on transforming assignments throughout the pandemic have discovered the price hikes, far too.

“Customers are clearly stunned,” stated Mike Dunn, CEO of Dunn Lumber, which operates constructing resources outlets throughout the area, “but it’s astounding how handful of are walking absent from jobs.”

Rates for 2x4s and related goods have tripled from a yr in the past. The cost of oriented strand board is about eight occasions higher than a calendar year in the past, he claimed. (OSB is a mixture of wooden and resin, identical to particle board or plywood.)

“We’re not owning people check with for the price tag and then go away the keep … They gulp and commonly make the acquire.”

“This is my 50th year” in the business, Dunn said. “I’ve never observed the current market something like this … It is just astounding.”

For homebuilders, a lumber provider can normally supply a selling price and stick with that price tag for 30 or 45 days, McKinnon mentioned.

“When issues seriously started off to choose off in the afterwards part of 2020, we ended up obtaining proposals from our lumber suppliers that claimed, ‘This is fantastic for a few times.’”

To offset skyrocketing prices, developers could modify how they do issues.

For a planned Capitol Hill apartment constructing, Cascade Designed developer Sloan Ritchie explained his organization is checking out working with other developing strategies and supplies, like cross-laminated timber and prefabricated steel panels, to see how the cost compares to lumber. “All choices are on the desk,” Ritchie explained.

“We’re trying to be imaginative and modern, but we’re not halting development or stopping developing,” he mentioned.

At another organization, Walsh Construction, “We’re on the lookout at: Do we swap to concrete? Do we change to metal?” mentioned normal supervisor Elizabeth Rinehart. “Is there any way to use a lot less wood?”